5 critical strategies to master fbs review from day one

5 critical strategies to master fbs review from day one

Blog Article

Understanding the Fundamentals of Foreign Exchange Trading: A Comprehensive Guide for Beginners

If you're brand-new to Forex trading, it can really feel frustrating at. You require to comprehend key ideas like currency pairs and market structure prior to jumping in. Want to recognize exactly how to construct a strong trading strategy that works for you?

What Is Foreign Exchange Trading?

Foreign exchange trading, brief for forex trading, involves the purchasing and marketing of currencies on a global market. You involve in this dynamic marketplace to make money from currency changes. Unlike conventional securities market, foreign exchange operates 1 day a day, five days a week, allowing you to trade any time that suits you.

In foreign exchange trading, you'll come across numerous aspects that affect currency worths, including economic indications, geopolitical occasions, and market view. You'll require to analyze these elements to make enlightened decisions. The marketplace is decentralized, suggesting there's no central exchange; instead, trading occurs with a network of banks, brokers, and financial organizations.

To obtain started, you'll intend to select a trustworthy broker, established a trading account, and establish a solid trading method. With correct education and practice, you can browse the forex market and job in the direction of accomplishing your monetary objectives.

Comprehending Money Pairs

In the world of foreign exchange trading, recognizing currency sets is crucial to making educated professions. Money sets consist of two money, with the initial one being the base currency and the second as the quote currency.

You'll generally experience major pairs, which consist of the most traded currencies, and minor sets, featuring less commonly traded money. Recognizing these sets assists you gauge market motions and make strategic decisions.

When you trade a money set, you're fundamentally betting on the strength of one currency against an additional. fbs review. Recognizing exactly how these pairs function will certainly provide you a strong foundation as you navigate the forex market and create your trading techniques

The Forex Market Framework

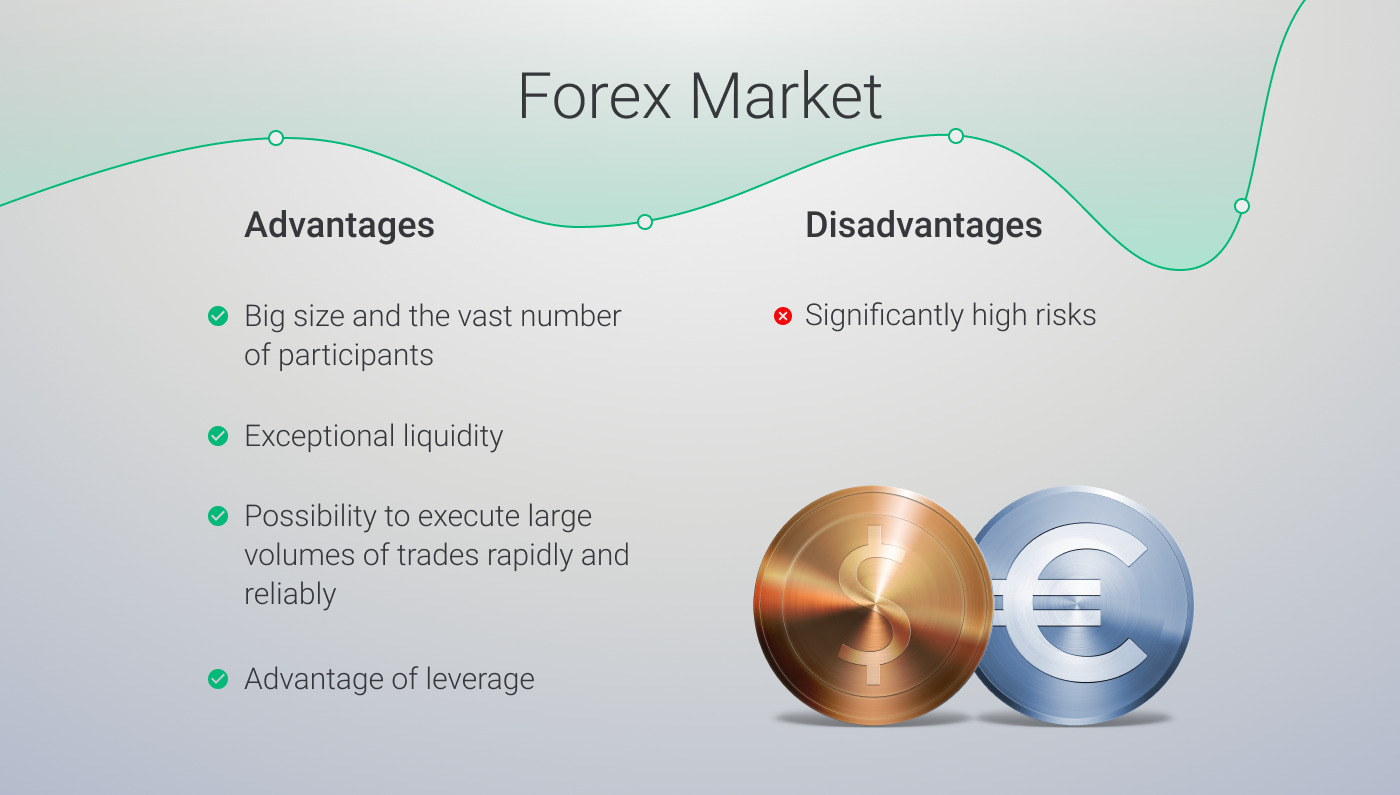

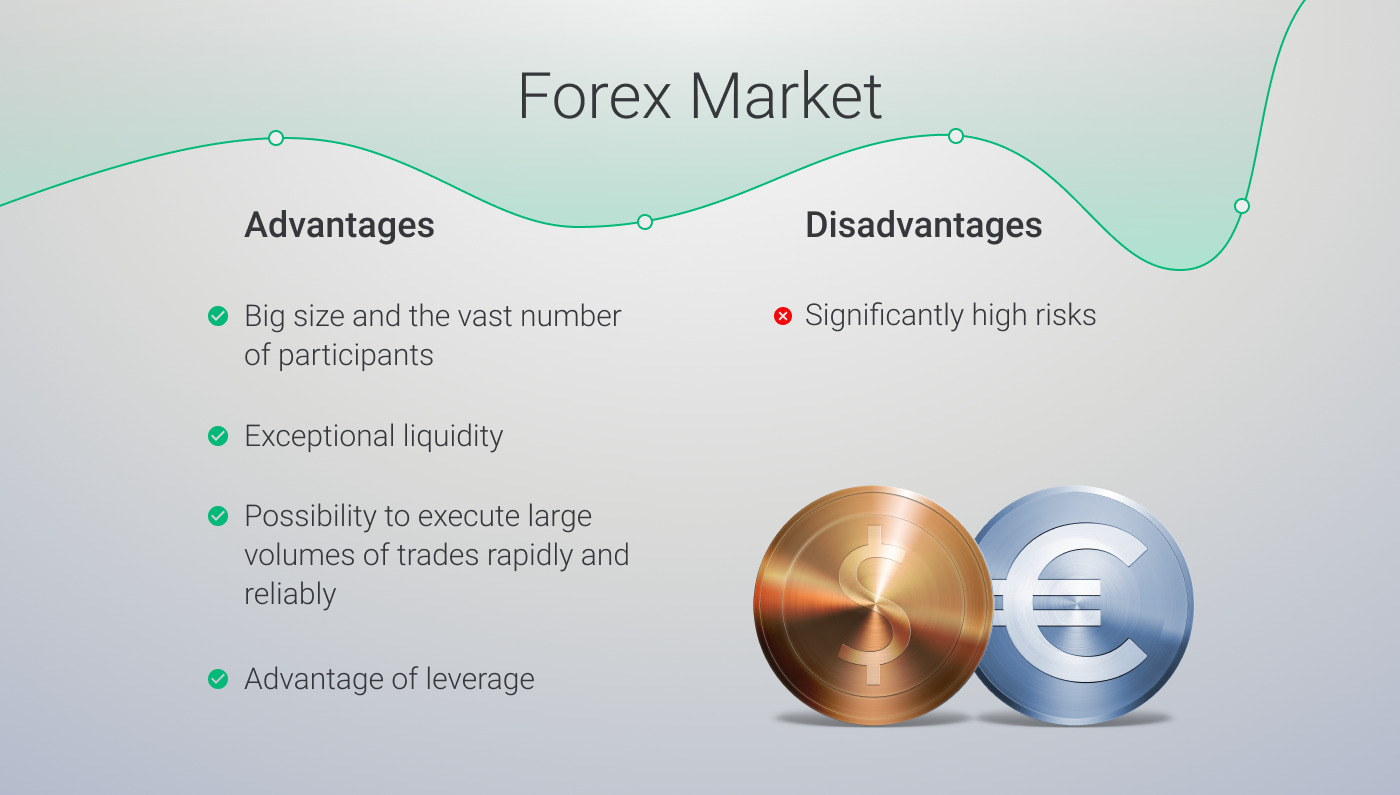

Comprehending the framework of the forex market is essential for any type of investor aiming to prosper. The forex market runs as a decentralized global marketplace, where money are traded 24/5. It's composed of various participants, including banks, banks, corporations, and private investors like you.

At its core, the market is divided into 3 main tiers: the interbank market, retail market, and broker-dealer networks. The interbank market involves huge banks trading money among themselves, while you, as a retail trader, typically access the market via brokers.

These brokers serve as middlemans, giving systems and tools for trading. It's vital to recognize this framework, as it affects liquidity, prices, and implementation. The even more you grasp just how these components connect, the far better furnished you'll be to make enlightened decisions and navigate the complexities of forex trading properly.

Kinds Of Foreign Exchange Analysis

Fundamental Evaluation Summary

Technical Evaluation Methods

While basic evaluation concentrates on financial indicators and political events, technological evaluation takes a various technique by checking out cost activities and trading quantity. By mastering these tools, you can make enlightened trading decisions based on historic price actions rather than exterior elements. Technical evaluation equips you to forecast future market movements properly.

View Evaluation Insights

Recognizing market belief is important for effective forex trading, as it reveals the overall state of mind of traders and capitalists. You can additionally utilize sentiment signs, like the Dedication of Investors (COT) report, to examine the positioning of huge players in the market. By integrating sentiment evaluation with technological and fundamental analysis, you'll boost your trading technique and make more informed choices.

Threat Monitoring Techniques

Effective danger administration techniques are important for any kind of Forex trader looking to guard their resources and enhance long-term productivity (tiomarkets review). Next off, never run the risk of even more than 1-2% of your trading resources on a single trade; this keeps your account secure from considerable losses.

Usage stop-loss orders to immediately shut professions at a fixed loss degree. This helps you stick to your technique and prevent psychological decisions. Expanding your professions across different money pairs can likewise reduce danger, as it protects against overexposure to a single market movement.

Ultimately, frequently review your professions to gain from both your successes and mistakes. By applying these threat monitoring strategies, you can improve your trading self-control and boost your chances of long-term success in Foreign exchange trading.

Choosing a Forex Broker

When picking a Foreign exchange broker, you require to consider vital variables like governing compliance, the trading platforms they provide, and the spreads and charges involved. These aspects can considerably impact your trading experience and general success. See to it to do your homework to discover a broker that meets your requirements.

Regulatory Compliance Needs

Choosing the right Foreign exchange broker rests on their governing conformity, as this guarantees your financial investments are shielded and the trading environment is fair. When reviewing brokers, check if they're managed by reputable authorities, like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) These bodies impose strict guidelines to assure brokers operate fairly and transparently.

Furthermore, seek brokers that supply clear info on their licensing and enrollment. Transparency in costs, terms, and problems is crucial. Ensure they supply appropriate client protection procedures, such as set apart accounts and unfavorable equilibrium security. By focusing on regulatory conformity, you'll develop a strong foundation for your trading trip and reduce prospective dangers.

Trading Platforms Supplied

Several key variables come right into play when examining the trading platforms used by Foreign exchange brokers. Consider the system's customer interface; you desire something instinctive and easy to navigate. Look for attributes like sophisticated charting tools and real-time information, as these can substantially enhance your trading experience. Additionally, check if the platform sustains automated trading or mobile gain access to, enabling you to trade on-the-go. Compatibility with various devices is likewise crucial; validate it functions efficiently on your preferred computer or mobile phone. Do not ignore the instructional sources and assistance offered through the system. A broker that supplies tutorials or consumer assistance can make a significant difference, particularly when you're simply starting in Forex trading.

Spreads and Costs

Spreads and costs play a crucial duty in your total Forex trading prices, influencing your potential revenues. When you choose a broker, you'll run into 2 primary kinds of spreads: dealt with and variable. Dealt with spreads continue to be constant, while variable advice spreads can rise and fall based on market conditions. Understanding these differences assists you evaluate your trading expenses.

In addition, be aware of any compensation fees that brokers might charge per trade. Some brokers use commission-free trading however make up with broader spreads, so review the great print thoroughly. Constantly contrast multiple brokers to find the best total costs for your trading method. By watching on spreads and costs, you'll assure even more of your revenues remain in your pocket.

Developing a Trading Strategy

A solid trading plan is important for anybody looking to prosper in the foreign exchange market. It acts as your roadmap, guiding your decisions and maintaining feelings in check. Start by specifying your trading goals-- whether it's to make a specific profit or gain experience. Next off, establish your danger tolerance. Knowing just how much you agree to shed on each profession is crucial for lasting success.

Pick a trading approach that suits your style, whether it's day trading, swing trading, or scalping. Include technical and essential evaluations to notify your choices. Set clear entrance and departure factors for each profession and develop a stop-loss to safeguard your resources.

Last but not least, evaluation and fine-tune your plan regularly. Markets change, and so must your strategy. By staying with your plan, you'll construct self-control and self-confidence, helping you navigate the usually unstable forex landscape with greater simplicity.

Regularly Asked Inquiries

What Is the Minimum Funding Required to Begin Foreign Exchange Trading?

The minimum capital to start forex trading differs by broker, however you can often begin with just $100. It's vital to select a broker with low minimum deposit needs to maximize your chances.

Exactly How Does Leverage Work in Foreign Exchange Trading?

Take advantage of in foreign exchange trading lets you control bigger Continue placements with a smaller sized amount of funding - CL markets review. It enhances both potential gains and losses, so you need to handle threat very carefully to avoid significant financial setbacks

Can I Profession Forex on My Mobile Device?

Yes, you can trade forex on your smart phone! A lot of brokers provide mobile apps that allow you implement professions, monitor the marketplace, and handle your account conveniently, making trading hassle-free anytime, anywhere.

What Are the Common Blunders Beginners Make in Foreign Exchange Trading?

Typical mistakes you make in foreign exchange trading consist of overleveraging, neglecting danger monitoring, neglecting market evaluation, and letting feelings determine discover here decisions. It's important to create a regimented approach and adhere to it for constant success.

Just How Can I Track My Foreign Exchange Trading Performance?

Report this page